Tax Planning and Charitable Giving

Your tax return is a financial fingerprint: it’s completely unique to you, complete with valuable information and planning opportunities, all of which is buried in dozens of pages and hundreds of numbers. Understanding your return equips us to have more impactful conversations, save money, and create better financial plans.

We’ll work alongside your Tax Professional to provide proactive tax planning

- Tax-efficient investment strategies

- Tax loss harvesting

- Tax bracket guidance and management

- Tax planning for restricted Stock Units, Grants, and Stock Options

- Guidance and review of Investment cost basis

- Estimated tax impact of a potential sale

Let’s create a charitable giving strategy that strives to benefit you as much as the charity.

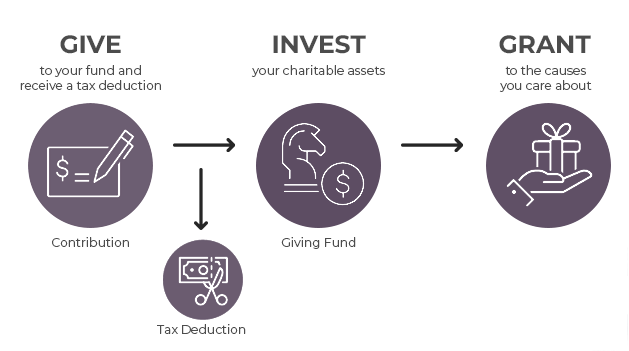

A Donor Advised Fund (DAF) is a charitable investment account that lets you contribute cash and/or appreciated assets. You receive a tax deduction on your donation while retaining flexibility for your giving strategy. A DAF is a great way to support the charities that matter most to you and your family.

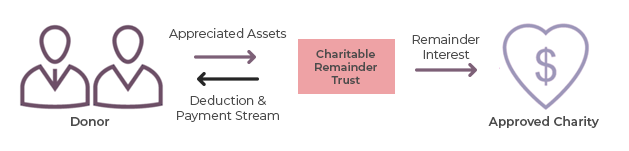

We’ll work with your estate attorney and tax professional to determine if a Charitable Remainder Trust is right for you. A Charitable Remainder Trust is one way to provide a gift to your favorite charity, receive a potential tax benefit, and an income stream for your retirement.